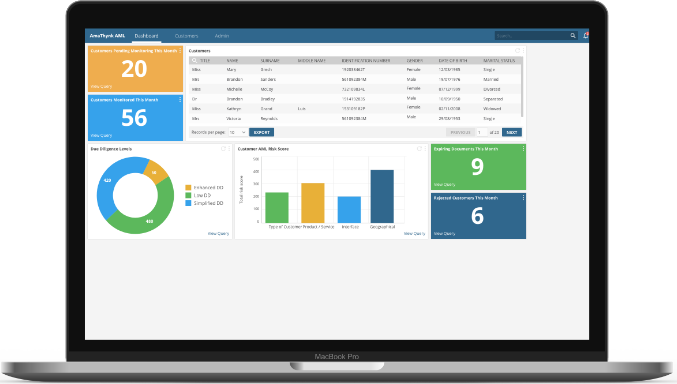

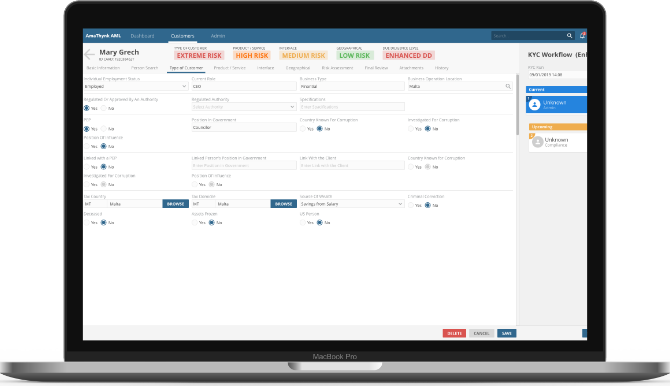

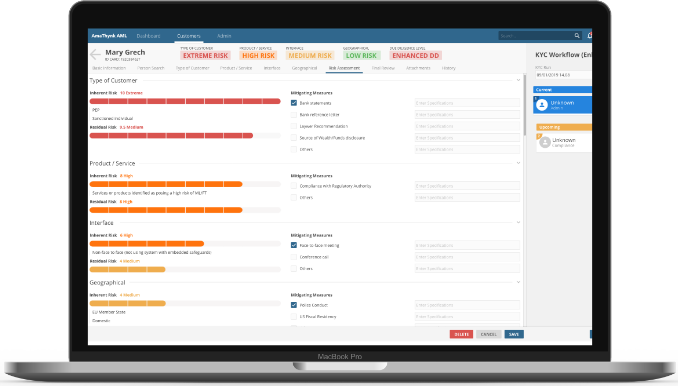

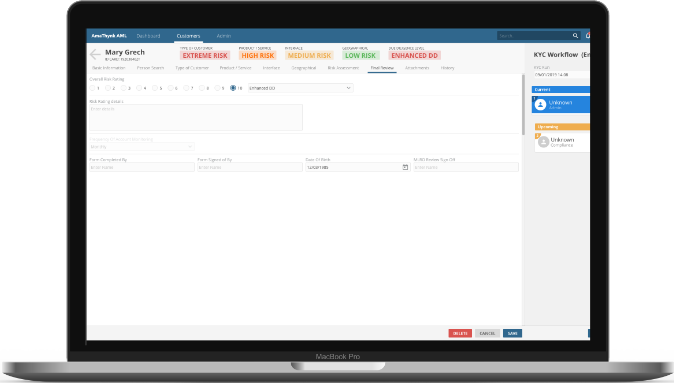

MitiGate is an Innovative & User-Friendly KYC Tool and AML Risk Assessment Platform

The anti-money laundering/counter terrorism financing regulatory framework is evolving at a fast pace, increasing the regulatory burden on all the obliged entities (including inter alia the bank & financial players, notary and law firms, accounting and audit firms, and VASP & e-wallet providers).

MITIGATE aims to offer an AML solution to support the performance of KYC/AML obligations, such as sanctions/PEP/Adverse news screening, customer risk assessment and aggregation of data for the business risk assessment.

Risk Assessment

Customer Screening

Regular Monitoring